SINGAPORE 10 May 2023 ecoSPIRITS has raised USD 10 million in an oversubscribed Series A funding round, led by New York-based circular economy investment firm, Closed Loop Partners. Four leading Asian and global institutional investors have also joined the funding round, including food sector private equity investor, Proterra Asia; Pavilion Capital; Convivialité Ventures, the venture arm of global wine and spirits leader, Pernod Ricard; and ecoSPIRITS’ existing venture capital investor, Wavemaker Partners. The Series A proceeds will be used to strengthen ecoSPIRITS’ leadership position in closed loop packaging technologies for spirits and wine and accelerate its research and development program.

“We are thrilled with the successful close of our Series A round, which not only validates ecoSPIRITS’ impressive progress in building a comprehensive technology platform, but also marks a significant milestone in our journey to global scale. We are equally honoured to welcome leading investors to our journey such as Closed Loop Partners, Proterra Asia, Pavilion Capital and Convivialité Ventures. The future gets brighter when more resources are invested in circular economy innovation.”

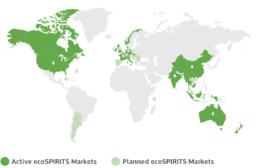

The new funding will help ecoSPIRITS scale up its hardware, software and Internet-of-Things (IoT) research and development program, expanding its investment in its Intelligent Circular™ roadmap. The funding will also be used to expand operations in key markets worldwide, including the United States, and grow its regional customer and engineering teams in Miami, London, Singapore and Shanghai. At the time of funding, the ecoSPIRITS’ closed loop technology platform is active or launching in 25 countries worldwide, including the majority of the world’s largest economies.

The new investors bring deep expertise in the circular economy, sustainability, the food sector and wine and spirits to the ecoSPIRITS journey. Series A lead investor, Closed Loop Partners, is a leading investment firm dedicated to the transition to the circular economy. A registered B Corp, Closed Loop Partners advances circular solutions across plastics & packaging, food & organics, fashion & beauty and supply chain technology.

The new funding will help ecoSPIRITS scale up its hardware, software and Internet-of-Things (IoT) research and development program, expanding its investment in its Intelligent Circular™ roadmap. The funding will also be used to expand operations in key markets worldwide, including the United States, and grow its regional customer and engineering teams in Miami, London, Singapore and Shanghai. At the time of funding, the ecoSPIRITS’ closed loop technology platform is active or launching in 25 countries worldwide, including the majority of the world’s largest economies.

The new investors bring deep expertise in the circular economy, sustainability, the food sector and wine and spirits to the ecoSPIRITS journey. Series A lead investor, Closed Loop Partners, is a leading investment firm dedicated to the transition to the circular economy. A registered B Corp, Closed Loop Partners advances circular solutions across plastics & packaging, food & organics, fashion & beauty and supply chain technology.

“There is immense opportunity to scale circular solutions across the supply chain for premium spirits and wine. Through their innovative reusable packaging technology, ecoSPIRITS is leading the transition to a less wasteful future for the industry – one that is not dependent on carbon-intensive single use glass. The Closed Loop Growth Opportunities Fund invests in scaling circular economy solutions for global industry, and we look forward to supporting the ecoSPIRITS team as they expand into new geographies and grow their global partnerships with leading wine and spirits brands.”

Proterra Asia is a private equity fund manager focused on investing in the Asian food sector. Over the past decade Proterra Asia has invested more than USD 1 billion in more than 30 companies that are contributing to the continued development of the food and agri industries across Asia. This investment was made via the Proterra Asia Food Strategy, which seeks to capitalise on the accelerating consumer demand that comes with growing urban populations and the emergence of a new generation of consumers looking for safe, high quality food products with a focus on health, nutrition, convenience, social impact and sustainability.

“At Proterra we believe firmly in the business case for more sustainable food and beverage packaging. We are incredibly excited about the potential impact of the ecoSPIRITS’ system in reducing carbon emissions and packaging waste while improving the business economics of the entire supply chain and look forward to partnering closely with Paul Gabie and his team as they continue to scale globally.”

Singapore-based Pavilion Capital is an active private equity investor across various sectors in Asia and embraces sustainability and ESG principles in its investment activities. Convivialité Ventures is the venture capital arm of the world’s second largest drinks company and leading ecoSPIRITS customer, Pernod Ricard. Through Convivialité Ventures, Pernod Ricard is partnering with and investing in start-ups that are embracing the future of hospitality, in areas such as technology, hospitality and entertainment. The investment comes as Pernod Ricard is in the process of expanding its existing technology partnership with ecoSPIRITS to markets outside of Asia.

“We are very pleased to participate in this investment, which will help develop a company that is offering such an innovative solution to our industry, by drastically reducing waste and carbon emissions. ecoSPIRITS’ approach is perfectly in line with our Group’s objectives to reduce its carbon emissions and we are looking forward to using it on a large scale around the world.”

Convivialité Ventures’ investment in ecoSPIRITS also marks the launch of a special investment program that will provide an opportunity for ecoSPIRITS’ most important global partners to support closed loop packaging innovation. Over time, the investment program will be open to key partners who are committing to the circular economy transition as part of their own supply chain innovation and sustainability programs. Customer partners participating in the investment program will be subject to confidentiality and other restrictions that guarantee universal access and equal treatment for all users of ecoSPIRITS’ global technology platform.

Existing ecoSPIRITS investor, Wavemaker Partners, will also be participating in the Series A fundraise, building on a seed investment in the company that was completed in late 2020. A leading Southeast Asia venture capital fund, Wavemaker Partners is dedicated to investing in solutions in enterprise, deep tech, sustainability and climate tech

“Research indicates that single-use glass packaging produces the highest greenhouse gas emissions compared to other beverage packaging materials. ecoSPIRITS’ reusable closed loop distribution system decreases emissions associated with spirits by approximately 60-90% while maintaining products quality and reducing cost for suppliers. Since our initial investment in ecoSPIRITS two years ago, we’ve been impressed with their growth as they’ve expanded their presence to 25 countries and forged partnerships with major spirits players like Pernod Ricard and Diageo.”

To strengthen its governance, ecoSPIRITS will expand its board of directors with the appointment of Cohen from Closed Loop Partners. In his role at Closed Loop Partners, Cohen co-leads the growth equity investment practice focused on advancing circular solutions in various sectors. Cohen’s appointment to the ecoSPIRITS board follows the appointment of Eric Tan as independent director in November 2022.

“We would like to thank Wavemaker Partners for being such a longstanding supporter of ecoSPIRITS. Wavemaker is not only an investor in sustainability start-ups but also a leader driving the sustainability movement, so we are grateful to have its ongoing support. We are also pleased to have Bennett Cohen join our Board of Directors. Bennett’s experience in building and scaling circular tech companies across the US and Europe will be invaluable as we enter this new chapter as a company.”

More details regarding ecoSPIRITS’ expanded research and development program and the evolution of its Intelligent Circular roadmap will be released in the coming months. For more information about the Series A fundraise, please contact ecoSPIRITS’ Senior PR Manager, Sonya Hook, via email at [email protected].

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: an investment firm, innovation center and operating group. The investment firm invests in venture, growth equity, buyout and catalytic private credit strategies on behalf of global institutions, corporations and family offices. The innovation center, the Center for the Circular Economy, unites competitors and partners to tackle complex material challenges and implement systemic change to advance circularity. The operating group, Circular Services, has twelve recycling facilities in operation today, and provides holistic, circular materials management to close the loop on valuable materials for municipalities and businesses throughout the United States. Employing innovative technology within reuse, recycling, re-manufacturing and re-commerce solutions, Circular Services improves regional economic and environmental outcomes by building resilient systems to keep food & organics, textiles, electronics, packaging and more in circulation and out of landfills or the natural environment. Closed Loop Partners is based in New York City and is a registered B Corp.

For more information please visit www.closedlooppartners.com.

About Proterra Asia

Proterra Asia is a private equity fund manager focused on investing in the Asia food sector. Over the past decade Proterra Asia has invested more than USD 1 billion in more than 30 companies that are contributing to the continued development of the food and agri industries across Asia. This investment was made via the Proterra Asia Food Strategy, which seeks to capitalise on the accelerating consumer demand that comes with growing urban populations and the emergence of a new generation of consumers looking for safe, high quality food products with a focus on health, nutrition, convenience, social impact and sustainability.

For more information please visit: www.proterraasia.com.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and spirit with consolidated sales amounting to €10,701 million in fiscal year FY22. The Group, which owns 17 of the Top 100 Spirits Brands, holds one of the most prestigious and comprehensive portfolios in the industry with over 240 premium brands distributed across more than 160 markets. Pernod Ricard’s portfolio includes Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey, Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur and Mumm and Perrier-Jouët champagnes. The Group’s mission is to unlock the magic of human connections by bringing “Good Times from a Good Place”, in line with its Sustainability and Responsibility roadmap. Pernod Ricard’s decentralized organization empowers its 19,480 employees to be on-the-ground ambassadors of its purposeful and inclusive culture of conviviality, bringing people together in meaningful, sustainable and responsible ways to create value over the long term. Executing its strategic plan, Transform & Accelerate, Pernod Ricard now relies on its “Conviviality Platform”, a new growth model based on data and artificial intelligence to meet the ever-changing demand of consumers. Pernod Ricard is listed on Euronext (Ticker: RI; ISIN Code: FR0000120693) and is part of the CAC 40 and Eurostoxx 50 indices.

For more information, please reach out to Emmanuel Vouin, Head of External Engagement: +33 (0) 1 70 93 16 34.

About Convivialité Ventures

Convivialité Ventures is the venture arm of Pernod Ricard. Convivialité Ventures invests in innovative and inspiring companies beyond Pernod Ricard’s traditional wine and spirits offerings in meaningful, sustainable and responsible ways. Our mission is to cultivate radically different products and services that will enhance and change the way people come together, socialize and entertain in the future. Convivialité Ventures operates globally with investments and teams in the US, Europe, Latam, China and India. The portfolio of more than 45 companies includes companies like Fever, Fetch, Avantstay, Summer Farm, Dunzo, Liquid Death, and Outdoorsy.

For more information, please visit www.convivialite-ventures.com or email [email protected].

About Wavemaker Partners

Wavemaker Partners is Southeast Asia’s leading VC firm investing in early-stage enterprise, deep tech, and sustainability start-ups. Since 2012, it has backed 190+ companies with over US 300 million in AUM across four funds and 25 exits valued at over US 1.8 billion. These exits include TradeGecko’s acquisition by Intuit, and Moka’s and Coins.ph’s acquisitions by Gojek. Today, 85% of Wavemaker’s active portfolio start-ups in Southeast Asia are aligned with at least one UNDP Sustainable Development Goal.

For more information about Wavemaker Partners, visit https://wavemaker.vc/ or email [email protected].

About ecoSPIRITS

ecoSPIRITS is a circular economy technology company that has developed the world’s first low carbon, low waste distribution technology for premium spirits and wine. Our patent-pending closed loop system nearly eliminates all packaging waste in the supply chain. By dramatically reducing packaging and transport, ecoSPIRITS provides both a powerful cost advantage and a transformative carbon footprint reduction. Founded in Singapore in 2018, the ecoSPIRITS technology is now available in more than 15 countries across Asia Pacific, Europe and the Americas. More than 1,500 leading bars, restaurants and hotels have adopted the technology, including Michelin-starred restaurants, World’s 50 Best and Asia’s 50 Best bars and iconic hotels. ecoSPIRITS is now rapidly building a global network of closed loop service, with coverage to grow to 25 countries worldwide by early 2023. Together with our brand partners, importers, distributors, wholesalers and venues, we are already making a difference. Each year, ecoSPIRITS and our partners are eliminating thousands of tons of single use glass waste, planting tens of thousands of trees, and inspiring others to change.

For information, please visit www.ecospirits.global.